The great thing about social media is that it allows someone like me to hear about all the rumors that are circulating in communities, but also questions that people have about COVID-19. The latest questions and rumors centered around things having to do with getting the vaccine, but also the new strains that we are all hearing about.

A year ago Tuesday, I wrote my first post about COVID-19. At the time, we were just learning about the new virus that seemed to be causing pneumonia with no other distinguishable cause. A new virus, it seemed, was to blame. SARS-COV-2 took hold of entire populations, crippling and shaking us to our very core. For about a year now, many have spent countless hours learning about the virus, the disease it causes, but also the deep, long-lasting impact it has had on families and communities at large.

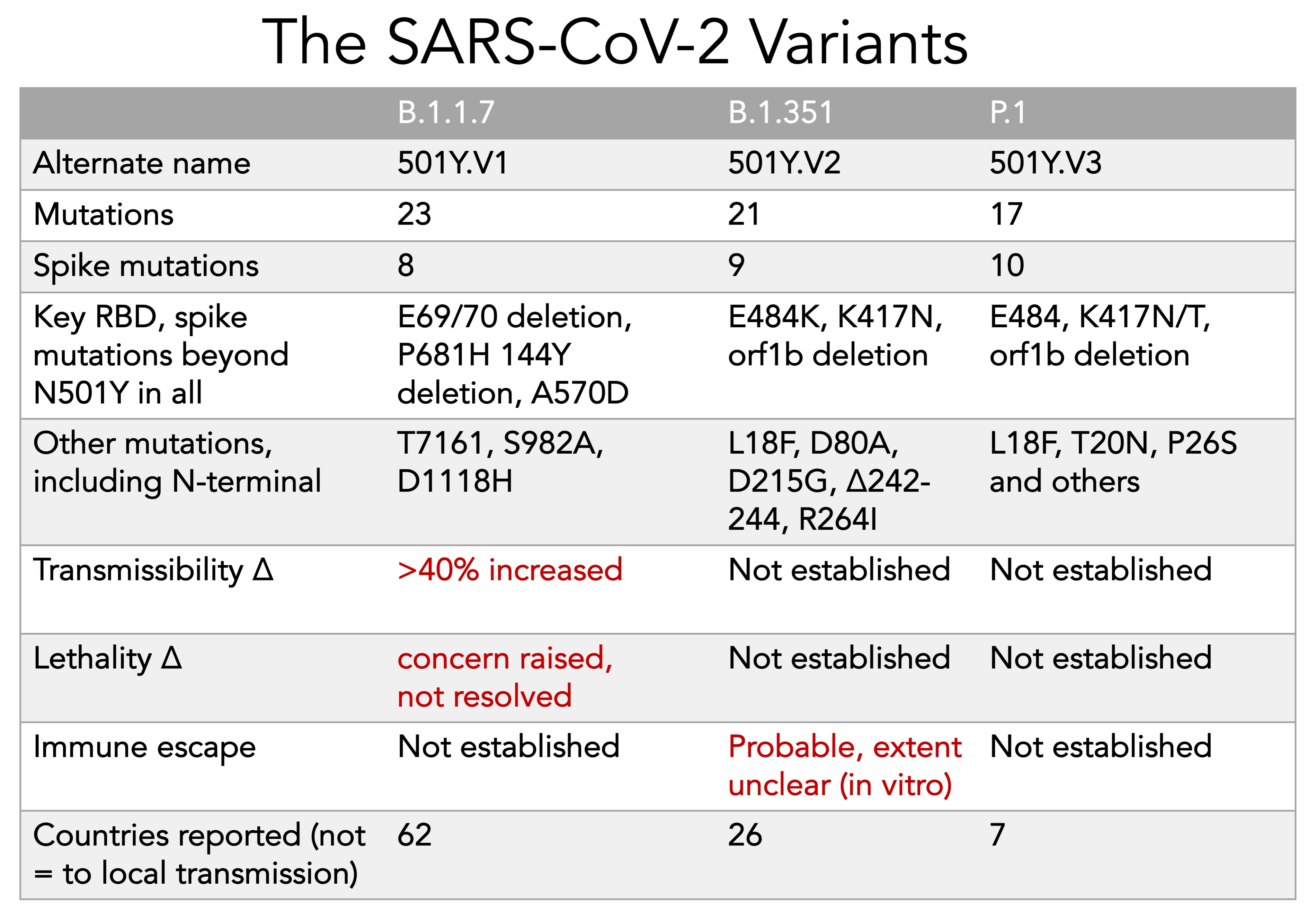

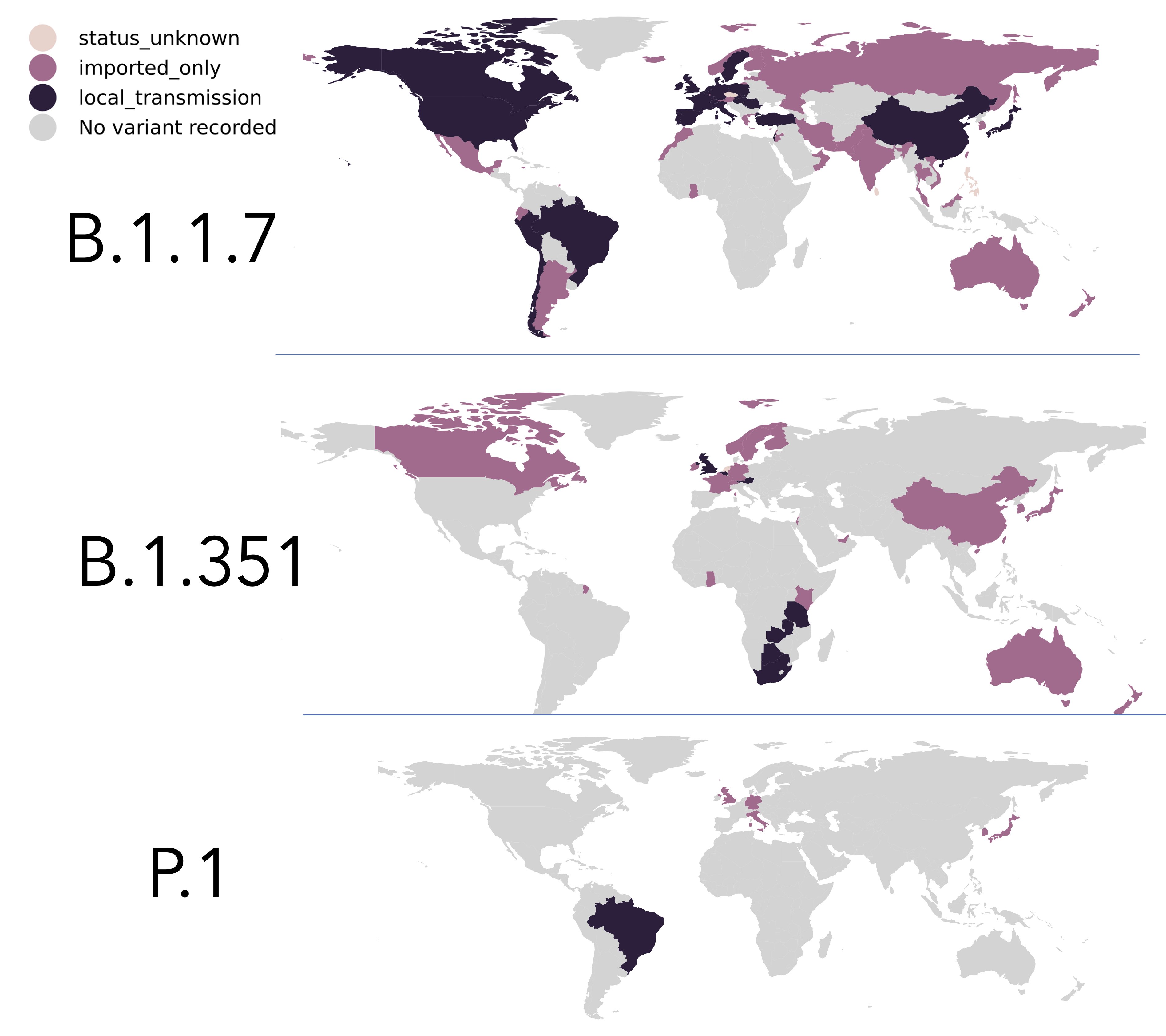

Today we are faced with variations of that original virus. Two in particular have dominated the headlines recently, though there are suspicions and early evidence suggesting others may also be in circulation. The two we have heard about the most are the ones that were originally identified in South Africa and the UK. There is a third that has been identified in Brazil, which appears to be more like the variant identified in South Africa.

Regardless of increased transmissibility or not, the experts agree: Masking, handwashing, distancing, avoiding indoor spaces, and vaccination are all musts.

People have a lot of questions about the vaccines because they are front and center, and in some cases, still unavailable. For those who live in states where the vaccine is both available and you are eligible, here’s a nice thread that answers a number of questions including whether the vaccine will work in 65+, and whether or not there will be enough doses for a second shot (fingers crossed this is a definite yes!!):

My parents were lucky enough to secure vaccinations today in Los Angeles county and I’m so grateful they were able to! For those lucky enough to get a vaccine appointment, here are some things to keep in mind:

- Plan for a long wait (my parents got to the site early and had to wait about 30 min, then another 30 min to get vaccinated, then another 15 min wait)

- Eat beforehand and/or have snacks/water with you

- Plan to use the bathroom beforehand. Consider wearing Depends if that is a suitable alternative depending on age of individual getting vaccinated

- Have a full tank of gas, especially if waiting in long lines at drive-up sites

- Take drivers license or other form of identification

- Have email or other confirmation available to show at the vaccination site

- Bring inhaler and/or other medicines you take in case the wait is extremely long

- Wear layers or pack a blanket in case it’s cold where you are waiting

Remember, a lot is happening in the coming weeks and months and the science is evolving quickly. Pay attention to major news outlets, your local department of public health, and/or sources you trust on and off social media. If you want to read the new administration’s strategy for addressing COVID-19 in the coming months, read this: National Strategy for the COVID-19 Response and Pandemic Preparedness.

This week, I began adding some information in Spanish on Instagram, and this week’s post also has a shareable graphic in Spanish for those interested.

Share, inform, educate as you’re able. Remember, in addition to the COVID-19 pandemic, we’re also fighting a viral infodemic. It will take all of us to beat both. We know that vaccines alone will not end this pandemic, so we have to continue to be patient and do all the things mentioned above to get through this:

Be safe and be well!